LCF3 – Livelihoods Carbon Fund 3

Sustainable Development Goals (SDGs) targeted

Description of the Project

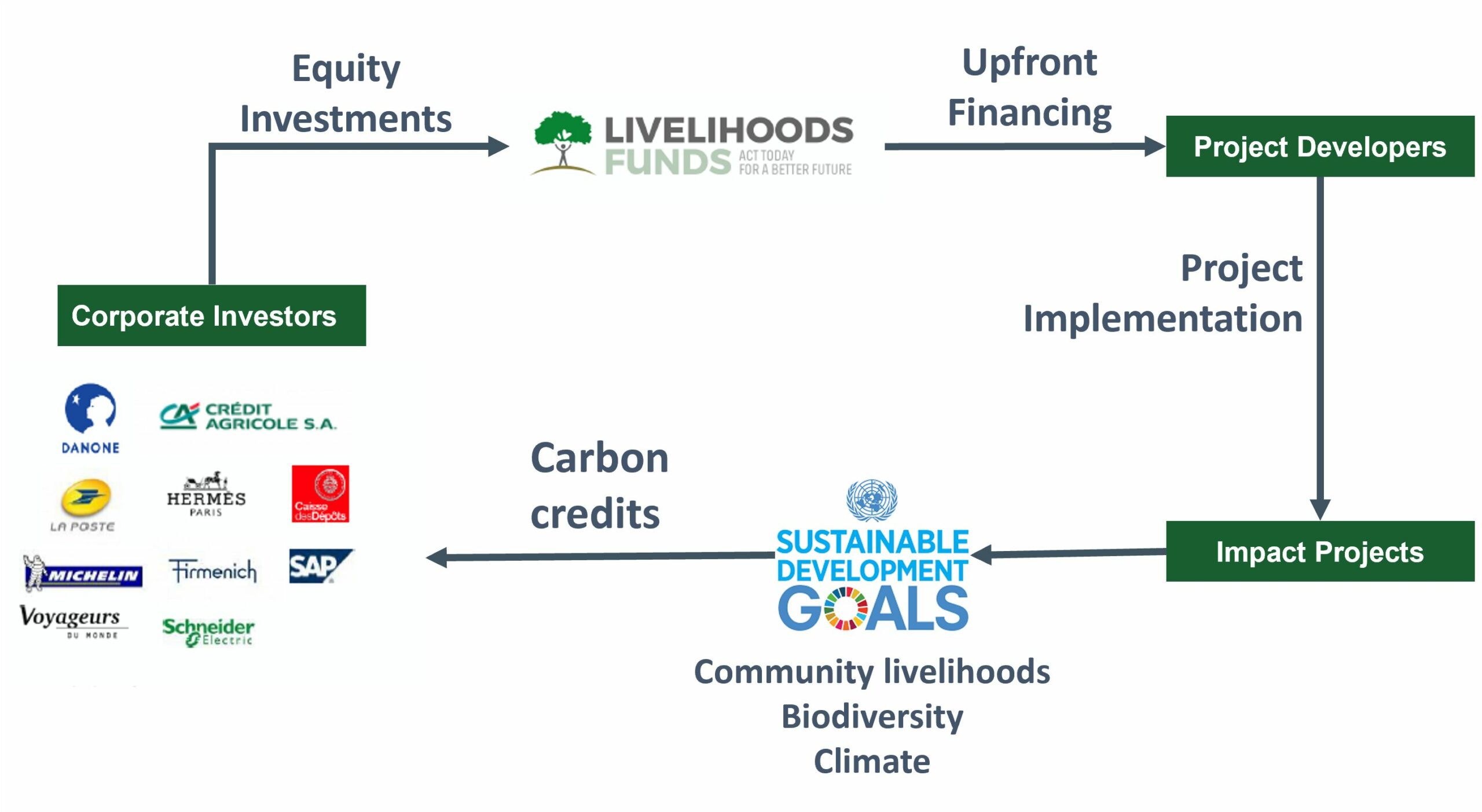

Livelihoods Venture created Livelihoods Carbon Fund 1 in 2011 and Livelihoods Carbon Fund 2 in 2017 to leverage the carbon economy to finance ecosystem restoration, agroforestry and rural energy projects to improve food security for rural communities and increase farmers’ revenues. The funds provide upfront financing to project developers for large-scale project implementation and maintenance over periods of 10 to 20 years. Livelihoods Venture is a social business based in Paris, is the initiator of several Livelihoods funds and is the Investment Advisor of LCF3.

In 2021, Livelihoods Venture launched Livelihoods Carbon Fund SICAV-RAIF (LCF3) as a regulated Luxembourg fund with a term of 24 years. LCF3 invests in large-scale natural ecosystem restoration, agroforestry, and rural energy projects in developing countries. LCF provide upfront financing to project developers for large-scale project implementation and maintenance over periods of 10 to 20 years. The funds receive result-based payments for the risks they bear in the form of carbon credits. This investment model is made possible thanks to long-term commitments from our investors. LCF3 is funded by 14 international corporate investors as well as financial investors with a total committed capital of $150m.

LCF3 aims at improving the lives of 2 million people while delivering up to 30 million tons of CO2 to be sequestered or avoided over the entire duration of the fund.

Innpact contribution

Innpact Fund Management S.A. was selected by Livelihoods Venture as its AIFM partner for the launch of the fund, the onboarding of investors in 2021 and the ongoing management of the Fund.

Livelihoods Ventures is acting as Investment Advisor to the AIFM.

Our AIFM team worked closely with Livelihoods Venture on all procedures required by the AIFM to set up and launch the fund as a Reserved Alternative Investment Fund (RAIF). Based on the advisory model, our AIFM services include the core functions of risk, portfolio management and investment committee. Further advisory services are provided by Innpact S.A.

Project Factsheet

- Name: Livelihoods Carbon Fund SICAV-RAIF

- Inception: June 2021

- Domicile: Luxembourg

- Initiators: Livelihoods Venture SAS

- Investment Advisor: Livelihoods Venture SAS

- Portfolio Manager: Innpact Fund Management S.A.

- AIFM: Innpact Fund Management S.A.

- Sector: Natural ecosystem restoration, agroforestry, and rural energy

- Geographic Focus: Africa, Asia, and Latin America

- Target Financial Intermediaries: Agricultural and rural communities

- Financial Instruments: Private debt: loans/grants for projects that will pay for themselves as the carbon credits are returned to investors by the projects

- Type: Luxembourg SICAV RAIF as an S.A.

- SFDR Classification: Article 8

- Info: https://livelihoods.eu/launch-of-a-new-livelihoods-carbon-fund-lcf3/

The content of this webpage is for information purposes only and should not be construed and/or considered and/ or taken to constitute advice and/or solicitation of an offer or a recommendation to enter into any transaction or buy or sell any financial instrument or to make any investment and/or as any other investment advice.