GEEREF

Sustainable Development Goals (SDGs) targeted

Description of the Project

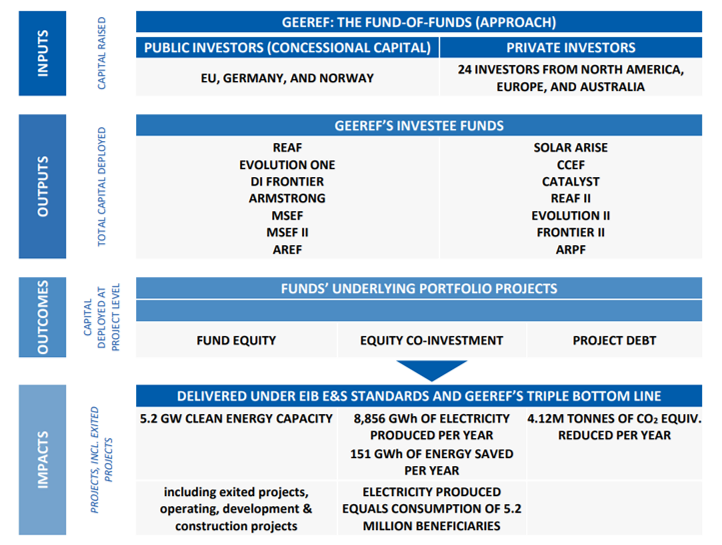

The Global Energy Efficiency and Renewable Energy Fund (GEEREF) is a climate focused fund of funds investing in specialist renewable energy and energy efficiency PE funds, developing small and medium sized projects in emerging markets.

GEEREF was structured to catalyse private sector investments into funds and underlying projects by leveraging the public sector seed contributions:

- GEEREF was initiated by the European Commission in 2006 and launched in 2008 with funding from the European Union, Germany and Norway, totalling € 112 million.

- GEEREF successfully concluded its fundraising from private sector investors on May 2015, which brought the total funds under management to € 222 million.

- GEEREF invests in private equity funds which, in turn, invest in private sector projects, thereby further enhancing the leveraging effect of GEEREF’s investments. It is estimated that, with € 222 million of funds under management, over € 10 billion could be mobilised through the funds in which GEEREF participates and the final projects in which these funds invest.

Source : https://geeref.com/index.html

Read the latest impact report of the GEEREF :

Innpact contribution

Innpact provided IMM & SFDR gap analysis for GEEREF as well as training to the GEEREF team on SFDR and IMM practices.

Additionally, Innpact designed the impact reporting procedure, data collection sheet and reporting template as well as produced GEEREF impact report.

Project Factsheet

- Name: Global Energy Efficiency and Renewable Energy Fund

- Inception: 2008

- Domicile: Luxembourg

- Investment Advisor: European Investment Bank Group

- Sector: Renewable Energy and Energy Efficiency

- Geographic Focus: Africa, Asia, Eastern Europe, Latin America and Middle East

- End‐Beneficiaries: Small and Middle Scale Renewable Energy projects

- Financial Instruments: equity

- SFDR Classification: Article 8

- Info: http://geeref.com/

The content of this webpage is for information purposes only and should not be construed and/or considered and/ or taken to constitute advice and/or solicitation of an offer or a recommendation to enter into any transaction or buy or sell any financial instrument or to make any investment and/or as any other investment advice.